Europe had just begun to see the light at the end of the Coronavirus tunnel, when the conflict between Russia and Ukraine broke out changing the forecasts again and putting the economic recovery into question. As a direct consequence, the growth prospects in the euro area have become very uncertain and reliant on the evolution of the situation.

According to the latest forecasts published by the European Central Bank (ECB), the Russian invasion of Ukraine is expected to significantly affect the euro area economy through tree main channels: trade, commodities and confidence.

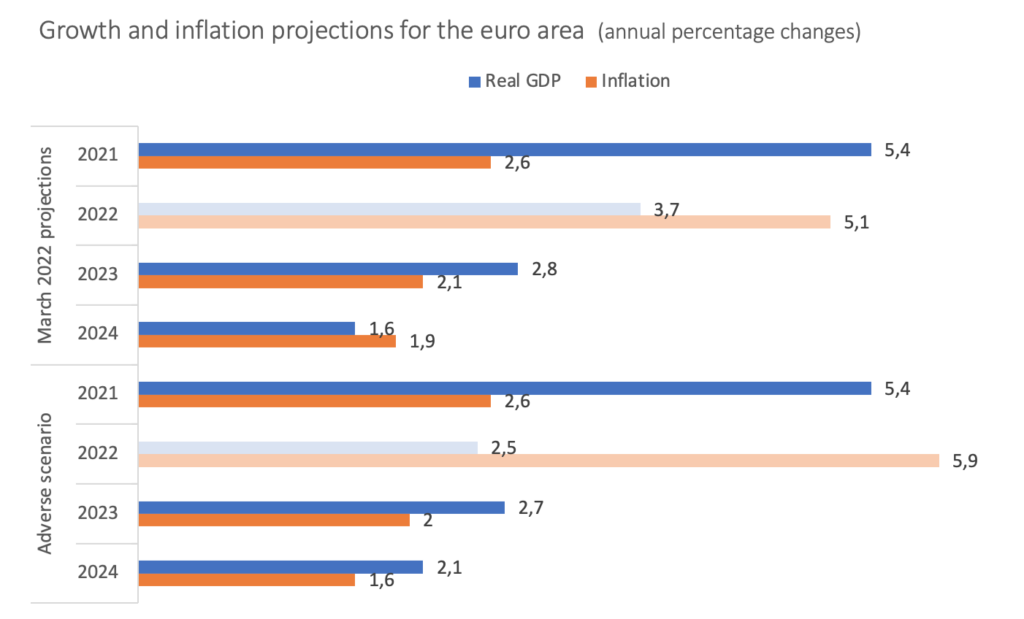

Based on the ECB macroeconomic projections, the growth in the Euro Zone have been revised downwards by 0.5 percentage points for 2022, going from the 4.2% growth forecast expected at the beginning of the year to 3.7% as of today. Overall, real GDP growth is projected to average 3.7% in 2022, 2.8% in 2023 and 1.6% in 2024. In an adverse scenario, where additional sanctions will be imposed and the conflict will sour, the projected growth would be 1.2% lower than the current forecasts. Differences would be more limited in 2023 and 2024 (Chart 01).

The conflict is also having a severe impact on the inflation which should remain at very high levels in the coming months due to the supply shock, generated on the energy and commodities markets (mining and agricultural), which is leading to a lasting increase in prices. According to the projections, an average inflation of 5.1% is expected in 2022 but will eventually fall within the ECB target of 2.1% in 2023 and 1.9% in 2024. Under an adverse scenario, inflationary effects due to higher commodity prices could amount to 0.8 percentage points in 2022 to reach inflation of 5.9%.

Most of the European countries are suffering from the surge in energy prices, which further reduce household disposable income, and the negative effects on confidence, which will weigh on domestic demand and trade. In addition, supply bottlenecks remain a headwind to recovery, but recent indicators suggest some moderate improvements in the course of 2022.

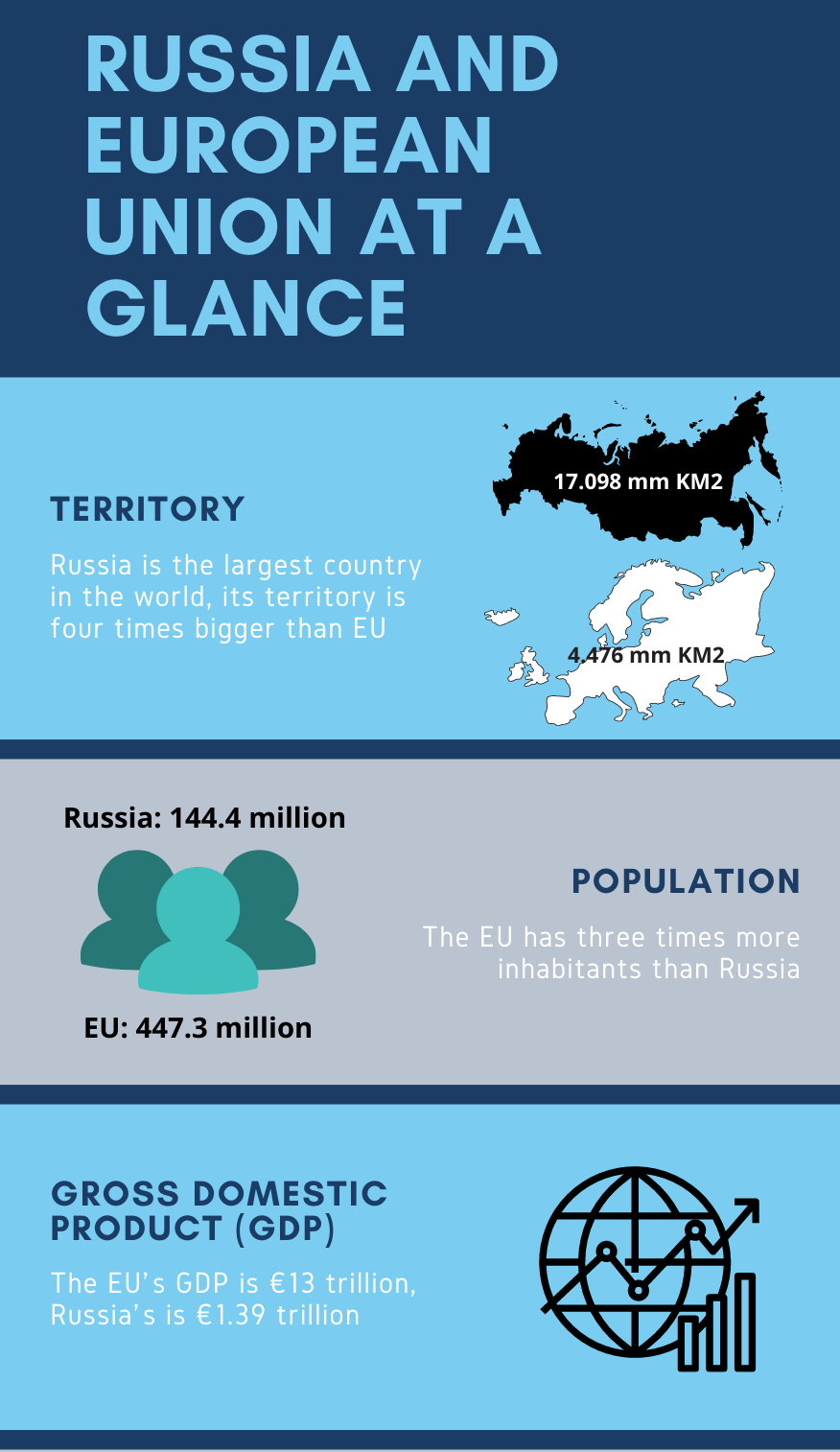

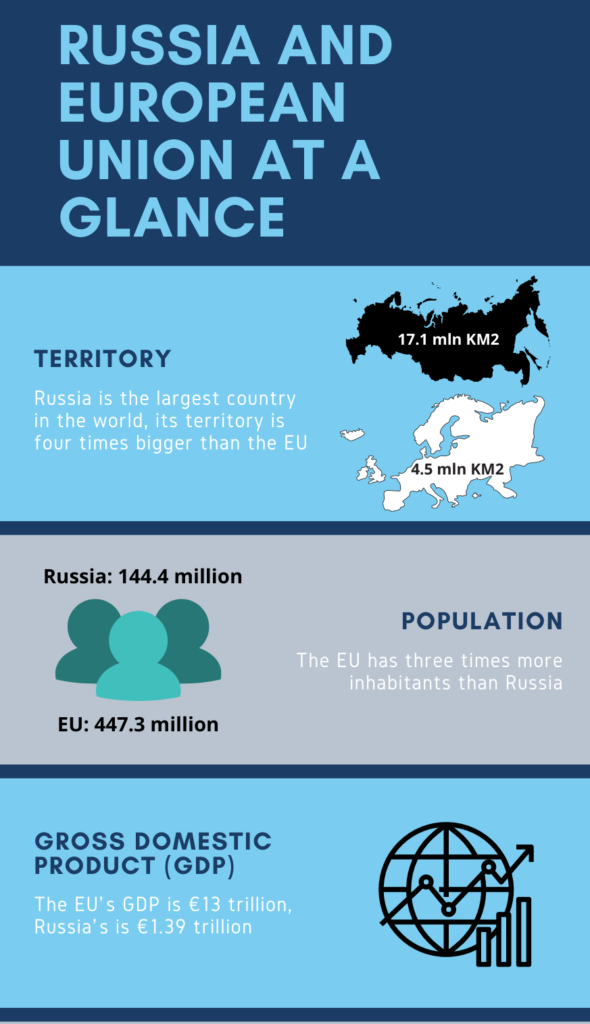

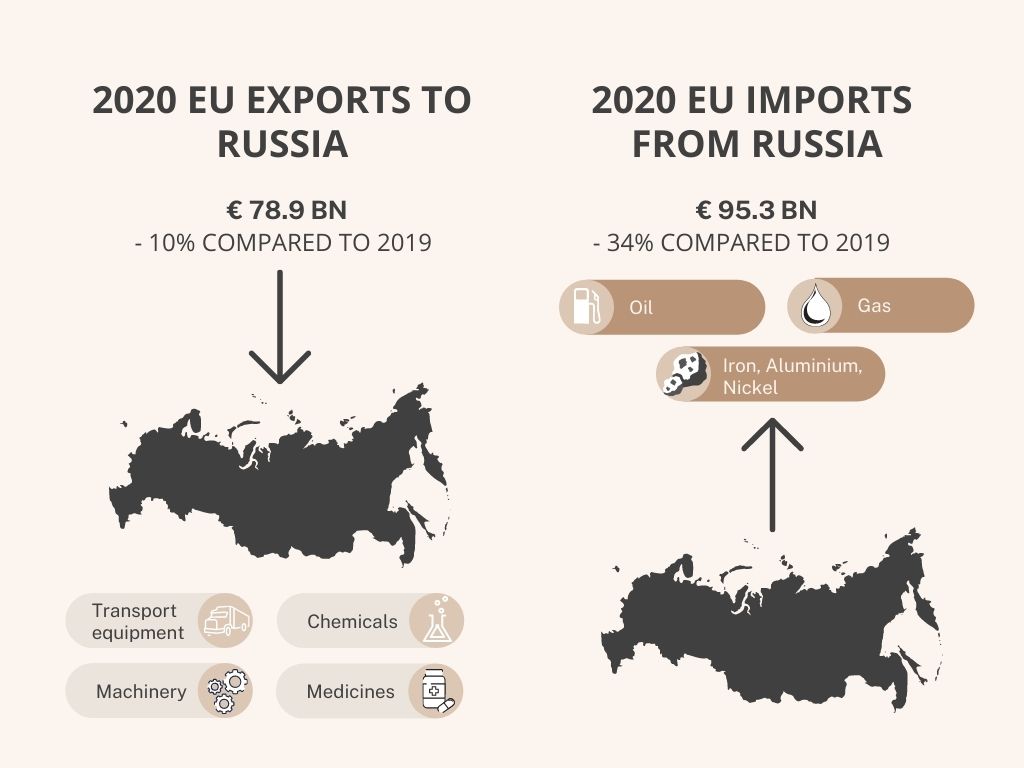

Trade – Following the Russian invasion of Ukraine, financial and trade sanctions were imposed on Russia through bans on imports and exports, translating into wide trade disruptions. However, exports of goods to Russia represent only 0.6% of the GDP of the European Union. In 2020, trade exchange between the two countries reached €174.3 billion, accounting over 37% of the Russian total trade and for the EU, only the 4.8% of the overall extra-EU trade 1.

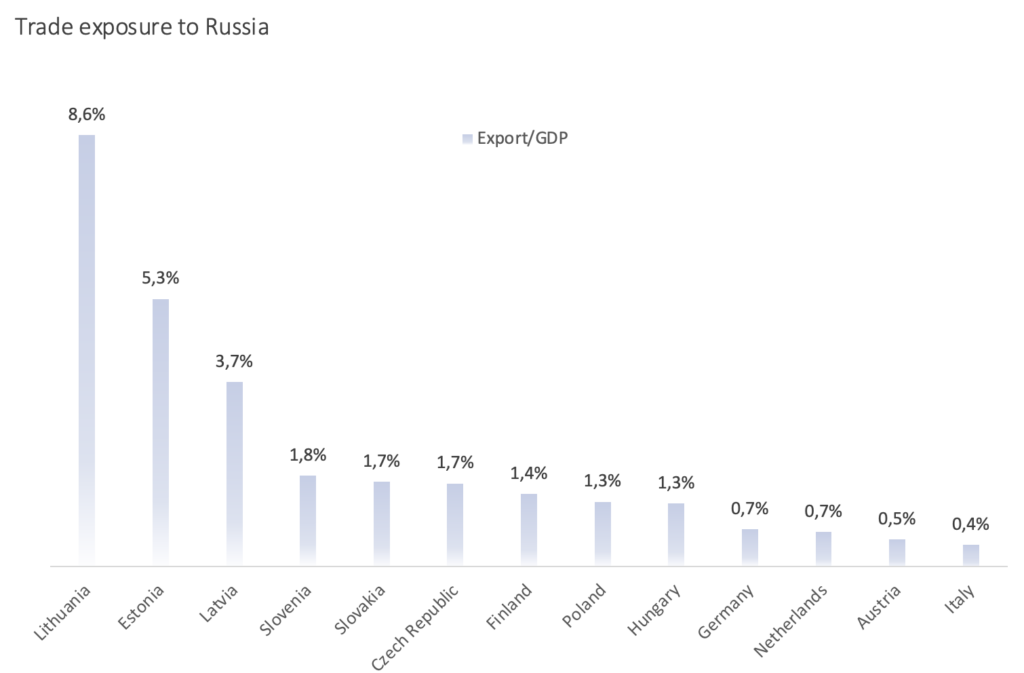

Moscow is not a common destination for EU investors mainly due to three factors: the low diversification of the economy -represented largely by oil and gas-, the sanctions that followed the Russian annexation of Crimea and the political risk of the country. While the total exposure of European Union remains limited and even more reduced for the large economies, the spillover effects are wider on Central and Eastern Europe, which have stronger trade ties with Russia (Chart 02).

Due to strong trade links, Lithuania is exposed for almost 9% of its GDP, followed by Estonia and Latvia, exposed for 5,3% and 3,7% respectively, for which Russia is mainly a source of mineral products. Exposure for Slovenia, Slovakia and the Czech Republic remains lower, below 2% of GDP. The exposure for Germany and Italy is reduced even more: less than 1%. Overall, Russia represents for a small share of European foreign demand therefore, from a commercial point of view, the effect on the GDP of the main European countries would be rather limited.

Commodities – on the other hand, the same cannot be said if we analyze the economic impacts of the conflict on the price of raw materials, which have undergone a significant rise, first of all the increase of energy prices. Indeed, Russia is the first energy provider for the euro area, accounting for 20% of its oil and 35% of its gas in 2020 2. The continent’s strong dependence on Russian energy imports will reinforce the need to look at other sources of energy supply capable of making up for Russian shortages.

Confident – clearly, the conflict in Ukraine puts global investors on alert. The uncertainty of the moment, along with the persistent geo-political tensions, increase the risk of volatility, with relevant negative repercussion on the confidence of European companies and therefore of investors.

After almost a month of tensions, the impact of the conflict in Ukraine on the euro area economy is undoubtedly considerable and, given the significant uncertainty linked to the length of the conflict as well as its outcome, it is very likely that the economic effects of this war will also carry over throughout 2023.

1 Council of the European Union, EU-Russia relations, 2020

2 European Central Bank, ECB staff macroeconomic projections for the euro area, March 2022